Introduction to the AI Bubble

The Bank of England has raised concerns about the current state of the equity market, particularly with regards to the valuations of companies involved in Artificial Intelligence (AI). Share valuations based on past earnings have reached their highest levels since the dotcom bubble 25 years ago. Although the BoE noted that these valuations appear less extreme when based on investors’ expectations for future profits, there is still a sense of unease. The central bank warned that the increasing concentration within market indices leaves equity markets particularly exposed should expectations around the impact of AI become less optimistic.

Toil and Trouble?

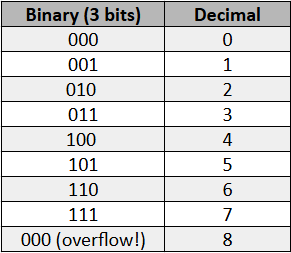

The dotcom bubble offers a potentially instructive parallel to our current era. In the late 1990s, investors poured money into Internet companies based on the promise of a transformed economy, seemingly ignoring whether individual businesses had viable paths to profitability. Between 1995 and March 2000, the Nasdaq index rose 600 percent. When sentiment shifted, the correction was severe: the Nasdaq fell 78 percent from its peak, reaching a low point in October 2002.

The AI Conundrum

Whether we’ll see the same thing or worse if an AI bubble pops is mere speculation at this point. But similarly to the early 2000s, the question about today’s market isn’t necessarily about the utility of AI tools themselves (the Internet was useful, after all, despite the bubble), but whether the amount of money being poured into the companies that sell them is out of proportion with the potential profits those improvements might bring.

Warning Signs Ahead

We don’t have a crystal ball to determine when such a bubble might pop, or even if it is guaranteed to do so, but we’ll likely continue to see more warning signs ahead if AI-related deals continue to grow larger and larger over time. The key is to keep a close eye on the market and be aware of the potential risks involved.

Conclusion

The Bank of England’s warning about the AI bubble is a reminder that investors need to be cautious and not get caught up in the hype. While AI has the potential to transform the economy, it’s essential to separate the reality from the speculation. By being aware of the potential risks and keeping a close eye on the market, investors can make informed decisions and avoid getting caught in a potential bubble.

FAQs

- Q: What is the AI bubble?

The AI bubble refers to the rapid growth in valuations of companies involved in Artificial Intelligence, which may be out of proportion with their potential profits. - Q: What is the dotcom bubble, and how is it related to the AI bubble?

The dotcom bubble was a period of rapid growth in the valuations of Internet companies in the late 1990s, followed by a severe correction. The AI bubble is compared to the dotcom bubble because both involve high valuations based on promising new technologies. - Q: What are the warning signs of the AI bubble popping?

Warning signs include increasingly large AI-related deals and high valuations that may not be sustainable in the long term. - Q: How can investors protect themselves from the potential AI bubble?

Investors can protect themselves by being cautious, doing thorough research, and not getting caught up in the hype surrounding AI companies.