Introduction to BBVA’s AI Initiative

BBVA is embedding AI into core banking workflows using ChatGPT Enterprise to overhaul risk and service in the sector. For the banking industry, the challenge of generative AI is rarely about adoption; it is about value extraction. BBVA has addressed this by integrating OpenAI’s platform directly into its operational backbone, a decision that will see the tool deployed across every unit of the bank. This tenfold expansion marks one of the largest enterprise deployments in the financial sector to date.

The Approach and Pilot Phase

The bank’s approach prioritises data over hype. BBVA began working with OpenAI in May 2024, rolling out 3,300 accounts to test the waters. This pilot phase allowed the institution to validate use cases before expanding to 11,000 staff. The results from this intermediate rollout of AI in banking provided the necessary business case. Employees using the tools saved nearly three hours per week on routine tasks. Furthermore, engagement was high, with more than 80 percent of users logging in daily. Staff created thousands of custom GPTs to handle specific collaborative and administrative duties, proving that utility often lies in bottom-up innovation rather than top-down mandates.

Impact of ChatGPT on Banking Operations

This agreement goes beyond simple productivity tools; it aims to reshape how the bank functions. BBVA will use the partnership to streamline risk analysis, a resource-intensive area for all financial institutions. Additionally, the deal focuses on redesigning software development processes and improving general employee support. “We were pioneers in the digital and mobile transformation, and we are now entering the AI era with even greater ambition. Our alliance with OpenAI accelerates the native integration of artificial intelligence across the bank to create a smarter, more proactive, and completely personalised banking experience, anticipating the needs of every client,” said Carlos Torres Vila, Chairman, BBVA.

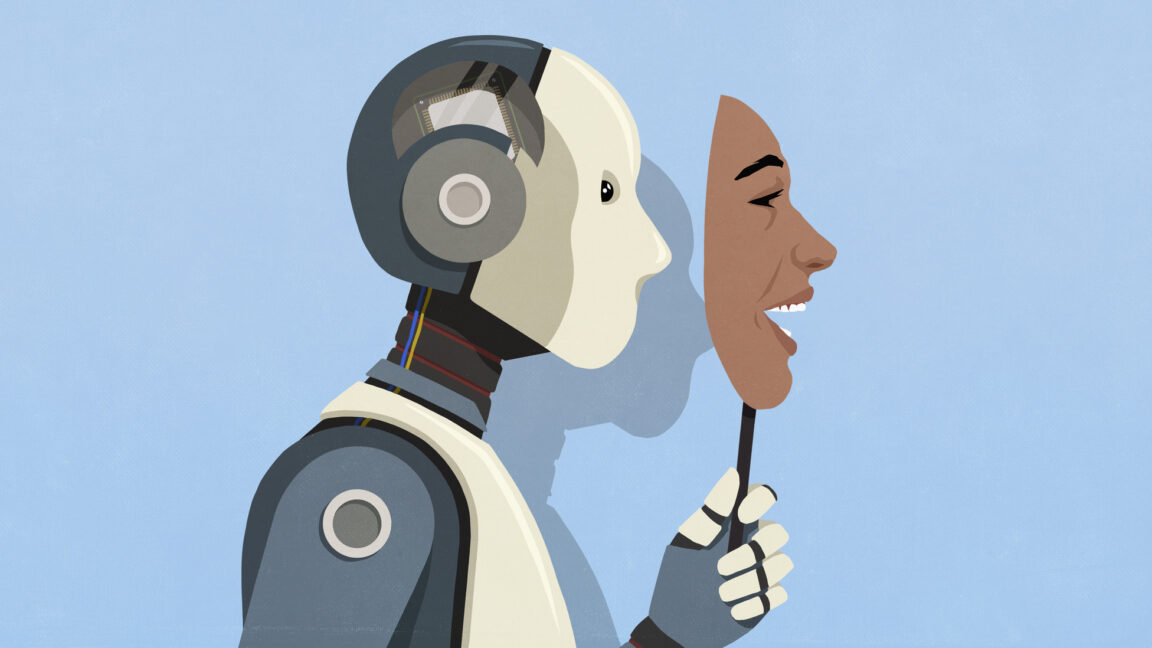

Improving the Banking Experience with AI

The initiative also targets the client interface. BBVA has already deployed ‘Blue,’ a virtual assistant built on OpenAI models that helps customers manage cards and accounts using natural language. Future plans involve integrating products so customers can interact with the bank directly through ChatGPT. To facilitate this, BBVA will have a dedicated team working directly with OpenAI’s product and research units. This direct line is intended to accelerate the bank’s transition into an “AI-native” institution. Sam Altman, CEO of OpenAI, said: “BBVA is a strong example of how a large financial institution can adopt AI with real ambition and speed. With this expansion of our work together, BBVA will embed our AI into the core of their products and operations to enhance the overall banking experience for their customers.”

Security and Training

Deploying AI into a heavily-regulated environment like banking requires strict controls. The global rollout includes enterprise-grade security and privacy measures, ensuring that client data remains protected while staff access OpenAI’s latest models. The ChatGPT deployment includes tools for creating internal agents that connect securely to BBVA’s existing systems and processes for banking. To ensure these tools are used effectively, the two companies are collaborating on a structured adoption model and specialised training programmes. This addresses the common enterprise pitfall where software is deployed without the necessary skills to leverage it.

Conclusion

BBVA’s integration of ChatGPT Enterprise into its core banking workflows marks a significant step in the banking industry’s adoption of AI. By prioritizing data-driven decision-making and focusing on value extraction, BBVA is set to revolutionize the banking experience for both its employees and customers. With its ambitious plans to become an "AI-native" institution, BBVA is paving the way for other financial institutions to follow suit.

FAQs

- Q: What is BBVA’s goal with its AI initiative?

A: BBVA aims to overhaul risk and service in the banking sector by embedding AI into its core workflows. - Q: How did BBVA start its AI initiative?

A: BBVA began working with OpenAI in May 2024, rolling out 3,300 accounts to test the waters before expanding to 11,000 staff. - Q: What benefits have BBVA employees seen from using ChatGPT?

A: Employees have saved nearly three hours per week on routine tasks, and more than 80 percent of users log in daily. - Q: What is the future plan for BBVA’s client interface?

A: BBVA plans to integrate products so customers can interact with the bank directly through ChatGPT, starting with its virtual assistant ‘Blue’. - Q: How does BBVA ensure the security of client data?

A: The global rollout includes enterprise-grade security and privacy measures, and the ChatGPT deployment includes tools for creating internal agents that connect securely to BBVA’s existing systems and processes for banking.